Do You Really Have Enough Life Insurance?

Do You Really Have Enough Life Insurance?

Because what you don’t know could cost your family everything.

“What you don’t know can cost you.” — Anonymous

So—you’ve got a life insurance policy. Maybe it’s one you bought years ago. Maybe it’s the one that came with your job. Either way, you feel covered. ✅

But here’s the real question...

If something happened to you tomorrow, would it be enough?

At C & K Healthcare Advisors, we find that most people think they’re protected—when in reality, they’re underinsured. That gap could leave loved ones scrambling at the worst possible moment. Let’s walk through how to find out if your coverage is enough, and how to fix it if it’s not.

🧠 The Life Insurance Coverage Myth

Over 50% of U.S. adults either have no life insurance or far too little, according to LIMRA. Why?

Because it’s easy to assume:

“I have coverage through work, I’m good.”

“I’m young and healthy—I don’t need much.”

“I just want enough for a funeral.”

But the truth is, life insurance isn’t for you—it’s for the ones you love. It’s the plan your family leans on when you’re no longer there to guide them.

👔 Employer Coverage: A Great Start, But Not a Full Plan

Group life insurance through your employer usually covers 1–2x your salary—maybe $50,000 to $100,000.

That sounds helpful—until you look at what your family would still need to cover:

Mortgage or rent

Utilities, food, transportation

Childcare or college tuition

Outstanding debts or medical bills

Funeral costs (which average $9,000–$15,000)

💡 Translation: Your work policy is a nice bonus, not your full safety net.

💸 How Much Life Insurance Do You Actually Need?

A common rule of thumb is 10 to 15 times your annual income, but that’s just a starting point. The smarter way is to consider:

Income replacement – How long would your family need your income?

Debt payoff – Mortgage, student loans, car loans, credit cards

Education funding – Kids’ college or private school

Final expenses – Funeral, burial, last medical bills

Legacy planning – Gifting to loved ones, charities, or business transition

At C & K, we walk you through a free Life Insurance Needs Analysis so you get the right amount—not more, not less.

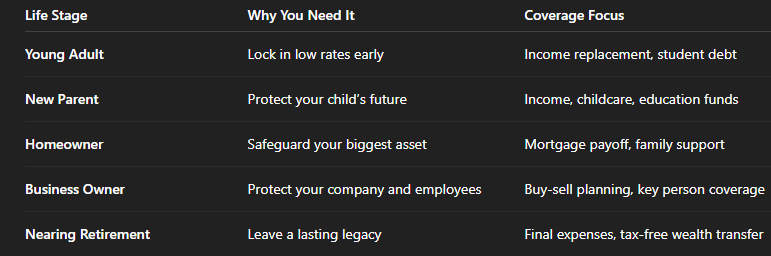

📊 Different Life Stages, Different Needs

🎯 Your coverage should evolve with your life. That’s where we come in.

🚨 Signs You Might Be Underinsured

If any of these apply to you—it’s time for a life insurance check-up:

❌ You haven’t reviewed your policy in 5+ years

❌ You’ve had life changes (marriage, children, new home)

❌ You only have life insurance through work

❌ You’re unsure what your policy actually covers

❌ You haven’t factored in inflation or rising costs

✨ You’re not alone—and we’re here to help you fix it.

💙 How C & K Healthcare Advisors Has You Covered

We make it simple, stress-free, and smart to review and improve your coverage:

✅ Term life for affordable, straightforward protection

✅ Whole life & IULs for lifelong coverage and tax-free cash value

✅ Final expense plans for seniors and end-of-life needs

✅ Children’s “3-Pay” plans that build lifelong, tax-advantaged wealth

Our advisors work with your budget, goals, and timeline—no pressure, no fluff, just facts and heart.

✨ Trusted Care. Tailored for You. That’s our promise to every family we serve.

🌟 Final Thought:

Having some life insurance isn’t the same as having enough. Don’t wait for a wake-up call. Let C & K Healthcare Advisors help you get it right today—so your family’s tomorrow is fully protected.

Because love isn’t just a feeling—it’s also a plan.